Copper demand forecast at 52,5 million tonnes by 2050.

Technology boom drives copper demand skyward

Access one of the world’s most essential resources with BDSwiss.

The Indispensable Element for Innovation

BDSwiss Markets SA (Pty) Ltd, (“BDSwiss SA”) are an authorised financial service provider who have been exclusively appointed by Tempestas Development to market their copper-product offerings to high-net-worth investors in South Africa and to manage a broker network in South Africa.

Learn More

Tempestas are early adopters and innovators who want to build a large community of investors and expertise in the new world of tokenization of real-world assets. This partnership allows Tempestas to enter the tokenization market, which introduces the copper commodity market to smaller investors globally and facilitates 24/7 trading.

Tempestas Copper Inc is an established Arizona based, USA, mining company who have an estimated 3B – 10B pounds (Lbs) copper deposit in the first 1 sq. mile of a total 7sq. miles owned with full operation funding. The mining business works with other entities in the Tempestas group of companies (Tempestas Development and Tempestas Copper Inc) to raise funds and drive innovation in the copper commodity space.

High-Quality Assets

The Kelvin Copper Deposit spans 7 square miles in Arizona's (USA) copper belt and features multiple high-grade deposits.

Safe Jurisdiction

Arizona offers a mining-friendly environment with established infrastructure and a history of copper excellence.

Certified Reserves

3B - 10B pounds (Lbs) estimated copper deposit in the first 1 sq. mile of a total 7sq. miles owned certified by NI 43-101 standards.

World-Class Team

CLed by experienced professionals driving innovation and sustainable mining practices.

Trusted Industry Leadership

A proven leader in copper mining and trading, with a track record of successful partnerships. Tempestas is actively investing in both operational and new mines, ensuring consistent growth and reliability for investors.

A Metal that powers progress

1. High Demand

Copper is a vital resource in modern technology, powering everything from renewable energy systems to electric vehicles. With increasing global demand, copper offers significant long-term investment potential.

2. Stable Long-Term Growth

Copper is more than just a metal. It’s the backbone of modern technology and a key to a sustainable future. As the world shifts towards green energy and advanced technologies, copper’s demand is set to soar.

3. Essential for Green Technologies

Copper is essential for both AI infrastructure and the green revolution. It powers fast data transfer and energy storage in data centers while also driving sustainability in wind turbines, solar panels, and electric vehicles. Tesla’s EVs require four times more copper than traditional cars, and Google’s data centers rely on it for efficient, eco-friendly energy transmission.

The Copper Mine in Arizona, USA

Situated in the southern Tortilla Mountains of east-central Arizona, the Kelvin Copper Deposit lies just 5 miles south-southwest of the ASARCO Ray Copper Mine, currently Arizona’s second largest copper producer.

Get to know the mine

The original Kelvin Copper Deposit consists of one (1) patented, and 53 unpatented lode mining claims, comprising the southwest half of Section 9, the eastern one-third of Section 8, and the northeastern-most corner of Section 17, of T4S, R13E of the Gila & Salt River Base and Meridian in Pinal County, Arizona). The project sits squarely within the northwest-trending Arizona Copper Belt, located roughly 60 miles southeast of Phoenix, and 60 miles north of Tucson.

Tempestas Copper took ownership in Q4 2020 and made investments into Phase 1 reporting by Mission Geo-Science and Phase 2 with the staking out additional claims. Drone mapping the entire property provided visual overview and culminated in the production of our 43-101 Technical Report produced by consulting geologist Michael R. Smith R.M (SME-Geology) of Geological Professional Services LLC. We have also engaged Leapfrog production in producing a Lidar 3D mapping of the project.

Early 2024 will lead with the instigation of road networks, amenities, and increasing the workforce with 14 new Geologists to assist in carrying out 8 deep drills and 20 short drills, enabling the start of production early 2028.

Since ownership, we have staked out additional claims from 32 to 226 thus increasing the size of the project from 640 acres to approximately 4520 acres. According to geographic maps and knowledge of the area, these claims will provide expected copper reserves extractable of minimum 3 Billion Pounds (lb) to a maximum 10 Billion Pounds (lb) which would at current prices value our in ground assets at $12 Billion to $43 Billion.

Location

Arizona – Pinal County

33°05’35.0″N 111°01’45.9″W

Claims staked: 226

Area: c. 4,520 acres (or, Seven square miles)

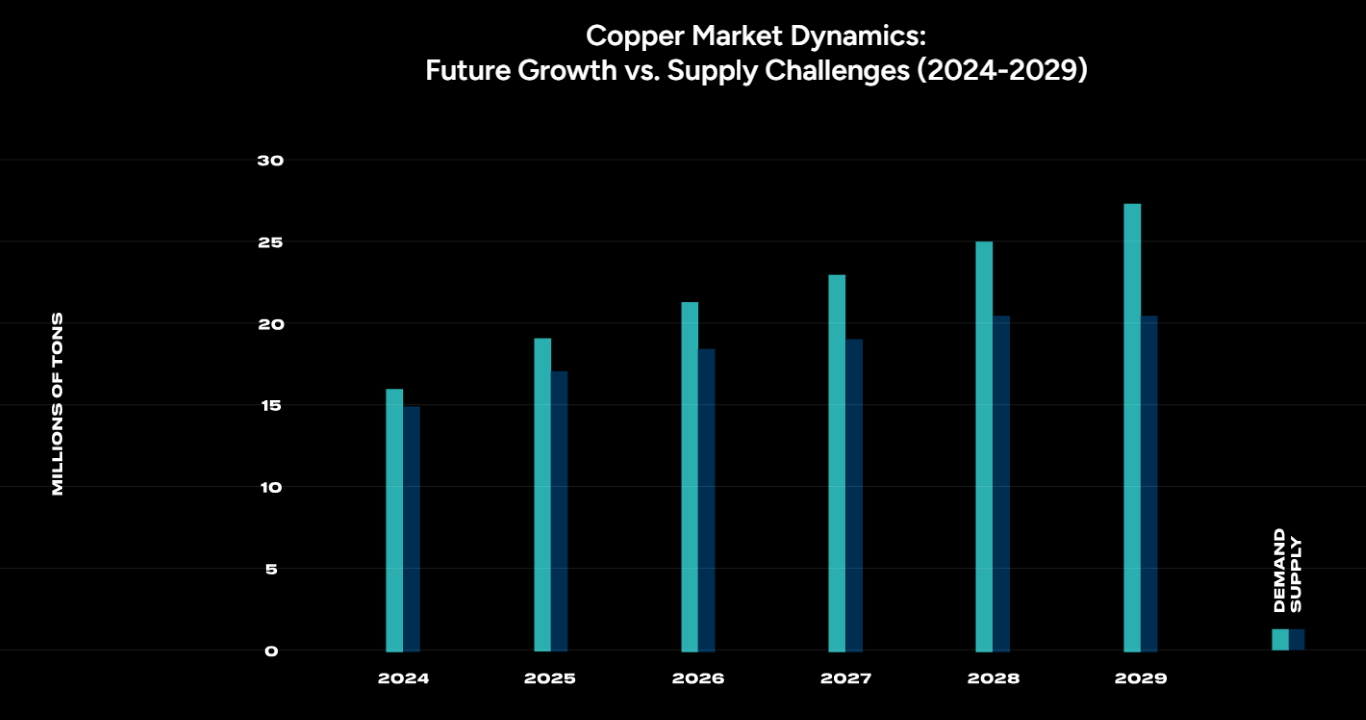

Market Dynamics

Future Growth vs. Supply Challenges (2024-2029)

Graph depicts strong demand growth driven by renewable energy and EV sectors vs constrained supply from aging mines and geopolitical risks.

Tesla's EVs contain up to 183 pounds of copper per vehicle, supporting their mission to create a sustainable future. Google’s data centers depend on copper for energy efficiency and reliability.

Current market dynamics show a long term upward trend in copper prices due to aging mines and geopolitical factors affecting supply. Strategic investments in copper now could yield significant returns.

Meet Leadership The Team

Andrew Paul

Investment Banker with 25 years’ experience incorporating Goldman Sachs, Morgan Stanley and Nomura International trading in London, Hong Kong, Singapore and Tokyo.

His expertise encompasses commercial disciplines in Risk Management, Equity Trading and Derivatives encompassing Delta 1 Long/Short, Portfolio and Bullet Swaps, charting and trading tool focused to generate opportunities within the scope and boundaries of trading strategies.

President

Andrew Costain

Investment Banker with 27 years’ experience in the Financial Services industry Andrew is both well versed and seasoned in global finance.

His experience of global trading practices is extensive, having held positions in the European, US and Asian markets in top banks including NatWest, BZW and CSFB, as well as Head of Global Trading at BlueOak Capital

Chief Operating Officer

John M. Johnson

Previous long-term experiences include ownership and management of mining, agriculture, the service industry, retail, construction, and land development in which entrepreneurial energies were put to effective use in profitable business activities.

Demonstrated impressive administrative, planning/forecasting, sales/marketing/promotion, oral/written communication, team building/leading and bottom-line profit skills.

Head of Mining Operation

Andre Peterkin

Previous long-term experiences include ownership and management of mining, agriculture, the service industry, retail, construction, and land development in which entrepreneurial energies were put to effective use in profitable business activities.

Demonstrated impressive administrative, planning/forecasting, sales/marketing/promotion, oral/written communication, team building/leading and bottom-line profit skills.

Financial Services expert for 23 years, with experience in Asset Backed financing covering soft and hard assets, seasoned in global markets across U.S, Caribbean and Europe. The competitive edge for Andre is his ability to look outside of the box to meet the firms’ strategic demands which capitalize on pure revenue streams.

Chief Strategy Officer

Development Team and Advisors

Michael R. Smith

Experienced mining professional with 45 years of international experience.

Registered Geologist (#35031) in Arizona and Registered Member (Geology) with the Society for Mining, Metallurgy & Exploration.

Principal Geologist

Gabriela Castro

Has extensive more than 20 years’ experience in business administration, commercial affairs, international trade, market analysis, research and development, focused on customer service.

She specialises in supporting companies looking to expand into North America.

President & Founder

Mary & Richard Darling

Darling Geomatics has been meeting its customers’ geospatial and digital data collection needs for over 27 years with high-tech drones, LiDAR, laser trackers, GPS and more.

Richard is a Registered Land Surveyor (RLS) in Arizona and an FAA Part 107 licensed UAV pilot with over 40 years of diversified surveying experience.

M.S. J.D. CEO / President & Principal Owner)

James R. Ashby

As Principal Engineering Geologist for MISSION Geoscience, overseeing all technical and business management for MISSION Geo.

James directs projects in engineering geology including: faulting, water & erosion, landslides, settlement, various geo-hazards, and mining.

Geologist & President

The Deal and Benefits

1.

The deal gives you the right to buy copper in 24-months with a 50% bonus uplift in holding.

2.

Euro-denominated from start of the investment.

3.

Two-year fixed term deal with 50% loyalty bonus paid in copper and added to the holdings over the 2-year term.

4.

Underpinned by future-mined copper.

5.

Based on copper volume, with final returns dependent on copper price.

6.

Online platform and downloadable certificate of holdings to confirm ownership and track performance of underlying copper price.

References

What the world says about copper

FAQs

Frequently Asked Questions

Who is behind the project?

Tempestas Copper Inc. is an established Arizona based mining company who have an estimated 3B – 10B pounds (Lbs) copper deposit in the first 1 sq. mile of a total 7sq. Miles owned certified NI 43-101 standards with full operation funding. The mining business works with other entities in the Tempestas group of companies (Tempestas Development and Tempestas Copper Inc.) to raise funds and drive innovation in the copper commodity space.

BDSwiss Markets SA are an authorized financial service provider who have been appointed by Tempestas to manage a broker network in South Africa.

What are the specific company details

Tempestas Copper Inc. – the mining company with the registered office at 41 University Drive, Suite 401, Newtown, PA 18940, USA.

For more information, see https://www.tempestas-copper.com/

Tempestas Development Limited is the partner company who administrates the fundraising for Tempestas Copper Inc.

It is a UK company, registered at One Arlington Square, Downshire Way, Bracknell, United Kingdom, RG121WA, with company registration number: 15964692.

BDSwiss Markets SA (PTY) Ltd, Financial Service Provider number FSP49479, company registration number 2015/156886/07 and address at 22 Bree Street, Cape Town, South Africa.

Get in touch via email at info@bdswiss.world

What are the funds being used for and why is Tempestas raising money like this and how does it fit into their overall financial plans?

This fundraise is a marketing investment to open up the $150 billion global copper commodity market. Traditionally, this has only ever been open to large funds and commercial traders.

It allows Tempestas to enter the tokenization market, which introduces the copper commodity market to smaller investors globally and facilitates 24×7 trading.

Tempestas are early adopters and innovators who want to build a large community of investors and expertise in the new world of tokenization of real-world assets.

Why Copper and why now?

Copper is a core industrial metal with growing demand in sectors that are rapidly expanding (energy transition e.g. Electric Vehicles and electronic devices).

It is essential in producing everything from solar panels and wind turbines to electric vehicle (EV) batteries.

How does the deal work?

This is a 2-year fixed term copper rights opportunity that is driven by the Euro-denominated spot price of copper. Holders of the copper rights will get a 50% staking bonus in their copper holdings (by volume) and can exit after 2 years at the prevailing Euro-denominated spot price of copper.

When you purchase the copper rights, you will be given a Copper-Pay certificate that entitles you to the equivalent number of TCu29 tokens after 2 years. These can be redeemed for physical copper and we are working to extend the range of exit options available.

For example, you buy copper rights worth 10,000 euros giving you 100 Copper-Pay tokens. After 2 years, you will have 150 Copper-Pay tokens due to the staking bonus. You can then redeem those for 150 TCu29 tokens which would be worth 15,000 euros assuming there is no change in the copper price since purchase.

If spot copper price had gone up by 20%, you would have EUR18,000 of value. If copper price had gone down by 20% you would have EUR12,000 of value.

What is the minimum investment?

Minimum entry is ZAR 100,000

What is the difference between Copper Pay and TCu29 tokens

Copper Pay is a token representing your rights to copper at the end of two years. Currently (February 2025), you can redeem your copper via physical delivery or in the form of the tradable digital equivalent in TCu29.

Each TCu29 token represents one pound (1 lb) of copper and is fully backed by physical copper.

Is the return guaranteed or is there any dependency on the price of copper?

The return is guaranteed in terms of volume e.g. you buy 100 pounds of copper at the start and get 150 pounds at the end of the term

This gives a hedge against the price of copper falling and extra upside if the price rises over the next two years.

What are the risks to investors?

There is no mechanism to exit early so your funds are tied up for 2 years.

Exposure to copper price, but with a 50% volume uplift to reduce this risk. Copper price charts can be found at Macrotrends.net

You are also exposed to foreign exchange rate fluctuations based on the Rand vs the Euro movement over time.

What is the current price of copper

Have a look here: Copper Prices Today – Live Chart | MacroTrends

This link shows you the long term trend in copper prices: Copper Prices – 45 Year Historical Chart | MacroTrends

How do I get my money out?

At the end of the 2-year term, you can decide if you:

- want to have your copper delivered;

- want to receive instead of physical copper the copper backed TCu29 in your crypto wallet of choice and then sell them on the market; or

- want to continue to speculate on the copper market by just holding the TCu29 in your crypto wallet

.

We are working on creating a range of different exit options and will announce them once they are formalized.

Can I exit early?

There is no opportunity to exit early.

Are there any institutional investors invested?

Yes, please read the press release here

Are there any relevant press releases?

“Tempestas Enters $800 Million Strategic Copper Delivery Agreements with WRA Environmental Engineering, Inc.SA“ in Costa Rica.

News on Copper

Rising Media and Industry Updates

High copper inventories to weigh on price amid demand recovery

A cash copper price has dropped 19.7% to $8,671 per metric ton

Copper could skyrocket over 75% to record highs

Rising demand driven by the green energy transition and a decline in the U.S. dollar…

European stocks set to mine the most as copper prices soar

Goldman Sachs is forecasting a 40% increase by mid-2025.